Explain the Difference Between a Budget Deficit and National Debt.

If the deficit gets turned into a sur- plus. The entire amount of money that the government has borrowed throughout the course of its history is referred to as the national debt.

Deficit National Debt And Government Borrowing How Has It Changed Since 1946 Business The Guardian

Start your trial now.

. Debt is like the balance on your credit card statement which shows the total amount you have accrued over time. View the full answer. The budget deficit means spending more than cashing in while the national debt means money owed.

When spending exceeds revenueor incomeits called deficit spending. A deficit refers to negative net money taken in over the course of some period. Solution for Explain the difference between the budget deficit and the national debt.

You can think of the total debt as accumulated deficits plus accumulated off-budget surpluses. National deficit is the shortfall between the national income and expenses during one year and the national debt is the accumulated deficit over a number of years. Explain the difference between a budget deficit and national debt.

More than there being an easily noticeable difference between the two they are actually connected. Tax due on taxable income of 100000 200000 and 500000. That is to say the deficit is how much more expenses over a certain period of time exceed income or in the case of the public deficit how much government spending over a year exceeds tax income.

The shortfall of the countrys income over expenses is termed as deficit whereas the sum of money owed by the nations government to others is called debt. The deficit is the difference between the money Government takes in called receipts and what the Government spends called outlays each year. Average tax rate on taxable income of 100000 200000 and 500000.

463 to compute the following. 2 Use the Marginal Income Tax Rates in Figure 156 see p. 1500 Posted By.

1 Explain the difference between a budget deficit and the national debt. 10302015 Question 00110133 Subject Economics Topic General Economics Tutorials. It represents the accumulation of past deficits minus surpluses.

Federal Budget Deficit. Debt on the other hand is an accumulated liability. Federal deficit is the difference between government spending and government revenue calculated every fiscal year the fiscal year goes from October 1 to September 30 of the following year whereas federal debt is the amount of money owed by.

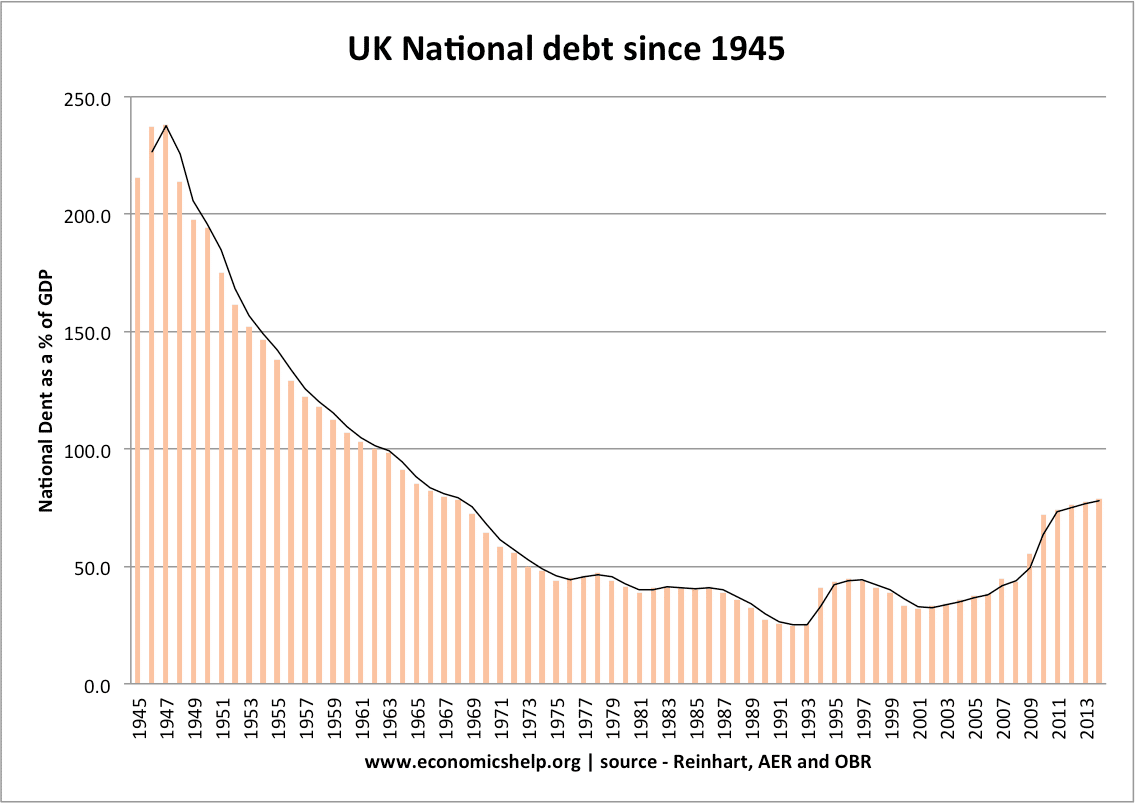

If the Federal Reserve lowers interest rates what will happen to the government budget deficit. Figure 2 shows the ratio of debtGDP since 1940. Until the 1970s the debtGDP ratio revealed a fairly clear pattern of federal borrowing.

Both the national debt and budget deficit are watched by investors and economists. The items included in the deficit are considered either on-budget or off-budget. They usually occur in any year when expenditures exceed revenues.

The on-budget deficits require. Receipts include the money the Government takes in from income excise and social insurance taxes as well as fees and other income. -deficit is a flow ex.

Some of the main differences between budget surplus and budget deficit are listed below. What will happen to tax receipts and interest expenses If the government wants to offset the effects of. Outlays include all Federal spending including social security and.

In contrast the budget deficit refers to how much the government has borrowed in one particular year. A national debt is all the money the federal government owes to bondholders. Explain the difference between the budget deficit and the national debt.

09302015 0220 PM Due on. A deficit budget situation means that the expenses of a government has exceeded the tax income during that period whereas a surplus budget scenario means that the tax income of a government exceeds its expenses. Government takes in from taxes and other revenues called receipts and the amount of money it spends called outlays.

Spending 500b per year more than collecting -debt is a stock measured at one point in time Calculate the effects of spending and taxing on the deficit and debt. If the deficit gets turned into a surplus what happens to the debt. At the end of fiscal year 2019 the Congressional Budget Office estimates that debt held by the public will equal 166 trillion or 78 percent of GDP.

Chapter 15 and 16. The budget deficit on the other hand refers to the amount of money borrowed by the government for a certain fiscal year. On a government-level the national debt is the accumulation of each years deficit.

Budget deficits may occur when a countrys government has expenditure that surpasses their income for the period of a year. A budget deficit occurs when a country business or an individual has spending that is greater than the revenue they receive over a specific periodusually measured as a year. The difference between the federal governments annual revenues and expenditures.

A budget deficit is a situation in which the government spends more than it takes in. See the answer Show transcribed image text Expert Answer The difference between budget deficit and national debt are. Debt is not necessarily an.

Explain the difference between a budget deficit and the national debt. First week only 499. The deficit is the difference between what the US.

The national debt is an accumulation of budget deficits to which money owed to other countries is added. In general budget deficit is very common while. They grow every.

Explain the difference between the federal budget deficit and the national debt. The national debt refers to the total amount that the government has borrowed over time.

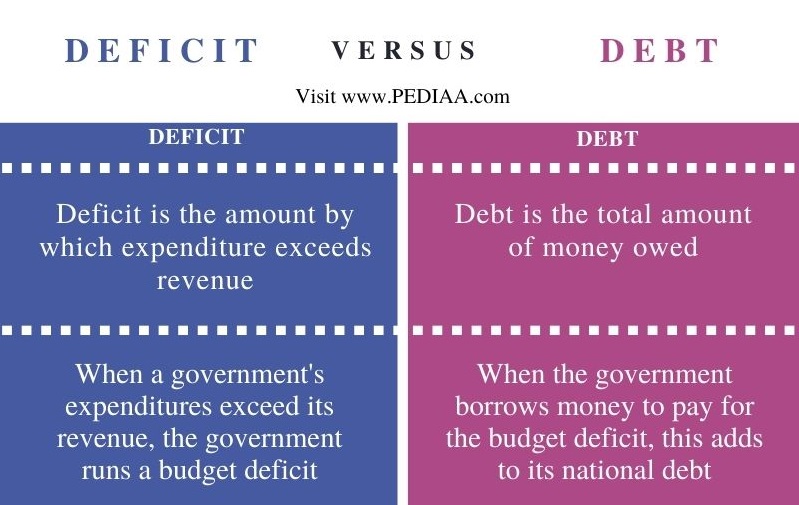

What Is The Difference Between Deficit And Debt Pediaa Com

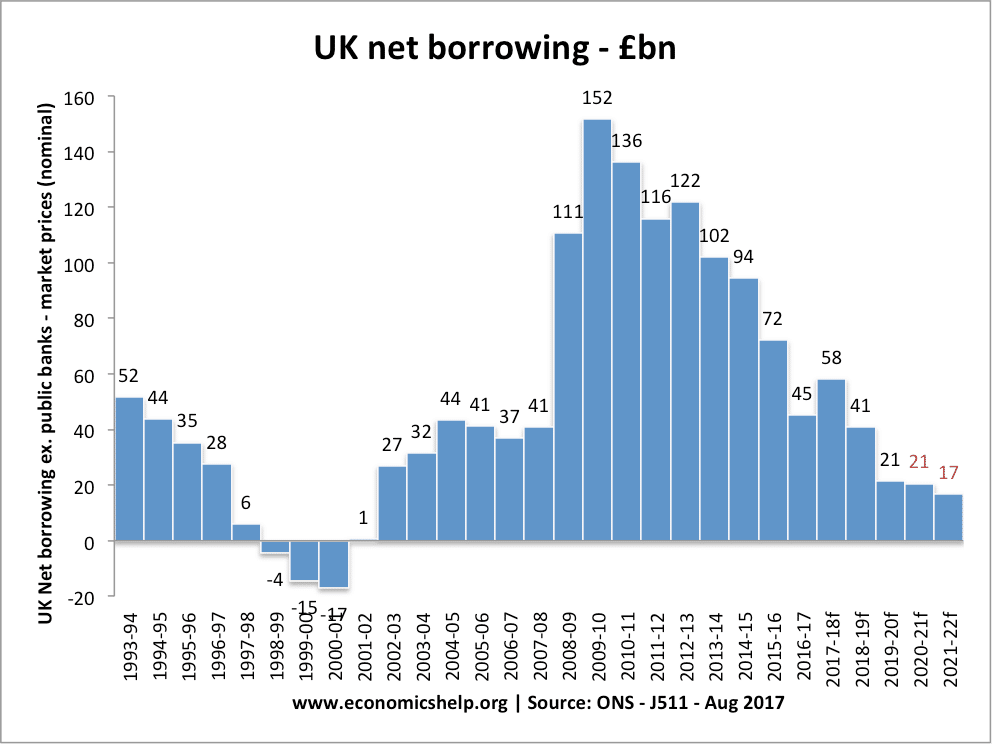

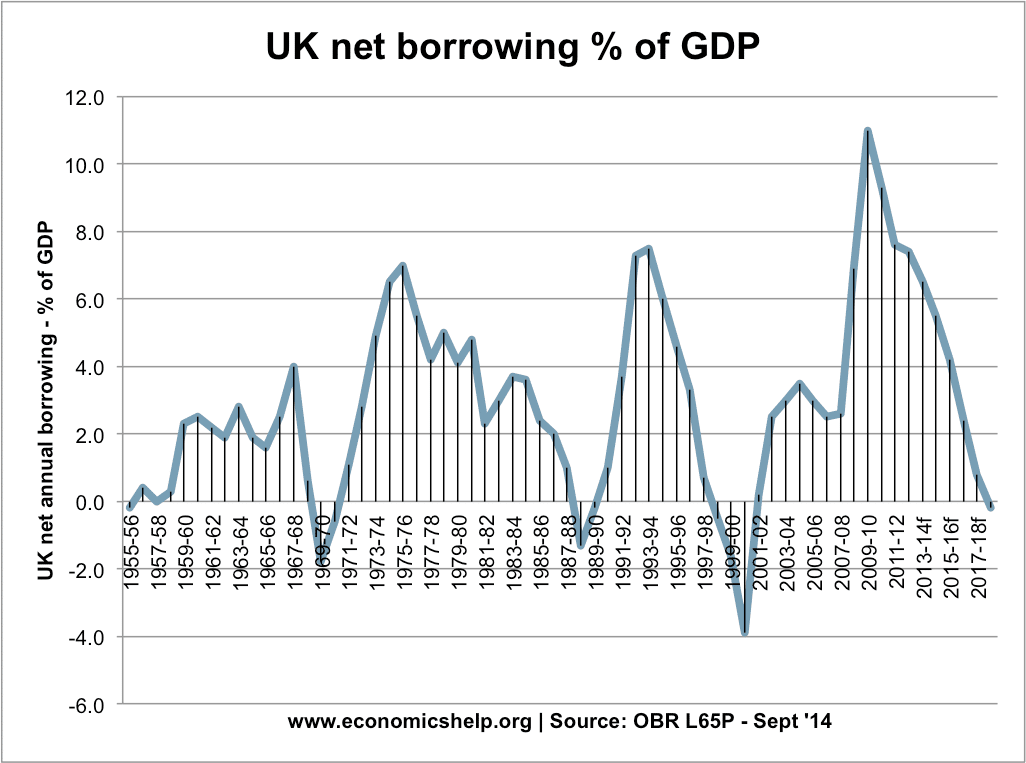

The Difference Between Deficit And Debt Economics Help

Comments

Post a Comment